-40%

Lunar Silver Coin Dragon 1/2oz 0,5 $ Australia PROOF COA+Box, Mintage 4,000

$ 89.16

- Description

- Size Guide

Description

Old Fashioned Way of Life gives more SafetyWhat you write down by

hand is secure against

Computer Espionage

...

and what you save in

Real Values

is

Secure

against

Bank Espionage

and

insured

against

Watering Down

of (Paper) Money Savings.

No Bank-Secret for Working People ? But Secret Negotiation of

T

ransatlantic

T

rade and

I

nvestment

P

artnership ?

More

Paper

for

the

private FEDeral Money FORGERS

and

Secret Contracts

...indeed really trustworthy

Since 100 yrs.

Gold

+

Silver

notably

performing

during Money

Inflation

/

Confiscation

by

CRASH

Fine precious Silver Coins for Stability of Savings

AUSTRALIAN LUNAR SILVER COIN SERIES II 2012

1/2

Silver Dollar

PROOF

"YEAR OF THE

DRAGON

"

1/2 Troy Ounce, 15.591 gr.

max. Diameter 36.60 mm

max. Thickness 2.30 mm

Specimen Quality 99.9% Pure Silver,

PROOF, uncirculated

Stunning Coloured Design,

Australian Legal Tender, Her Majesty Queen Elizabeth II on obverse.

Numbered Certificate of Authenticity

Limited

Mintage: only

4,000

PROOF

Please distinguish, the

non-PROOF

version has a mintage limit of

170,000

!

some dealers may try to declude by "expert" grading of the non-PROOF coins

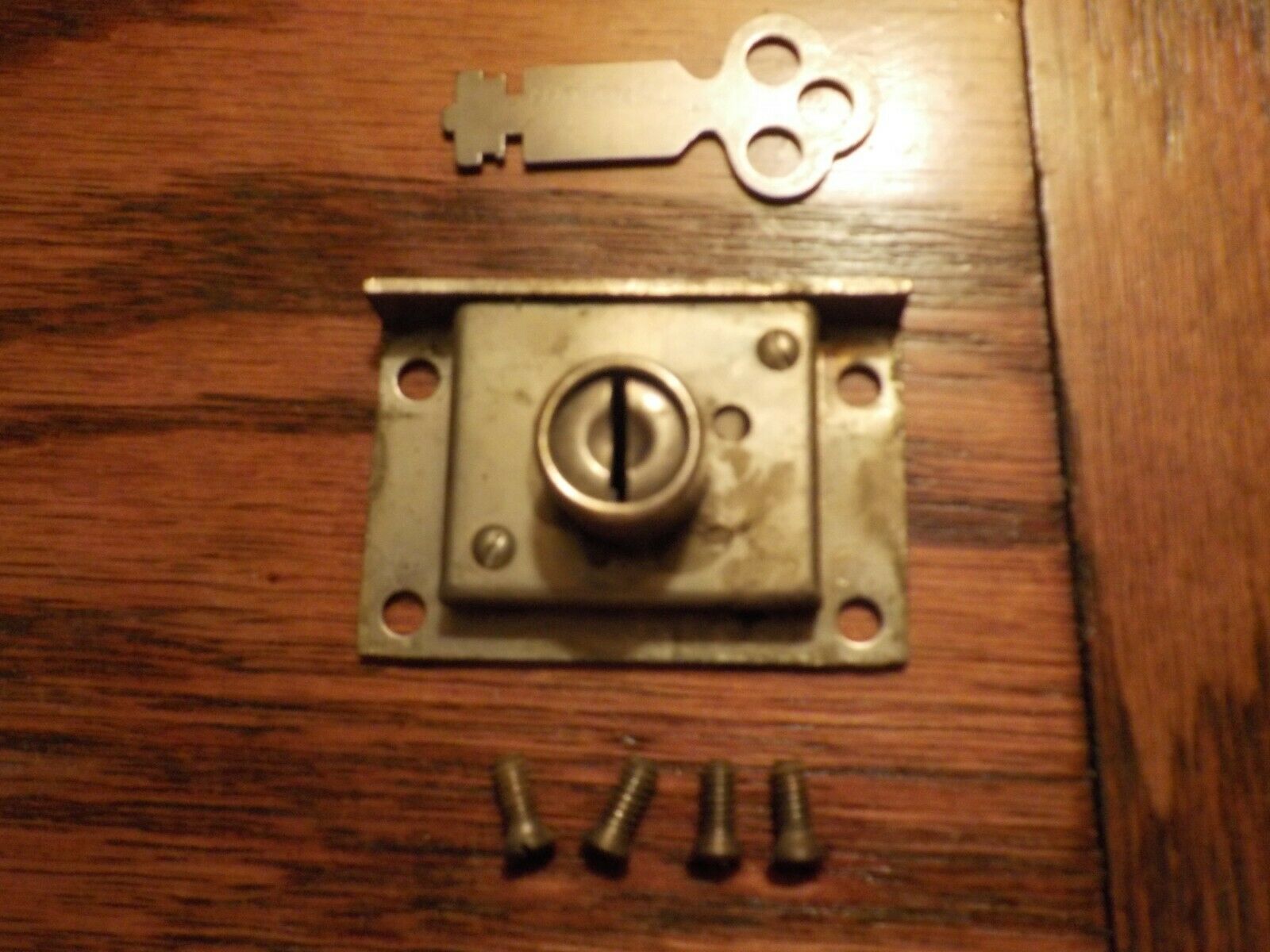

( see the 2nd picture )

The coin is capsuled and was bought from the official German distributor of Perth Mint

including COA certificate and Presentation Box.

Prospected numismatic value:

Limited Editions have a better value increase in

years of high

mintage,

in opposition

to mint

to

order

coins

The Perth Mint is always sold out in this

PROOF

Dragon

Coin.

I remember the

mintage difference between PROOF version 4,000 and non-proof 170,000

pieces

So

in addition to the silver price rally,

I expect a

Numismatic Value Increase add. for the PROOF Version

Some Words about

Precious Metals

for

Retirement S

avings

We live in a time of

overboarding State

D

ebt

caused by

Income TAX refusal

of Rich People

and Tax

Displacement

!

to Consumption Tax.

Tax

Deficit

filled up by

excessive

!

Credit

Spending

!

Repayment of this excessive Credits planed with

INFLATED Money

so with

Less Purchasing

Power

Additional

on every

IN-

FLATION

must follow

DE

-FLATION

/

Decrease

of

Credits

+

Increase of Interest Rate

DE

FLATION

cause

LOSS

on Financial Market

+

works as a

Secret

Tax

on

Savings...

un

legitimated by Law

LEVERAGE LOSS OBJECT LESSON:

I

f You own

Treasury Bonds

over 100

US$

/€uro duration

10

y

.

and

1.40 $

fixed Yield

(also as a part of capital life insurance, pension fonds + other finance products !)

And

i

f the interest rate has only climbed

up

again

to lousy 5%,

AT WHAT PRICE CAN YOU SELL

?

But we have seen over 10% Inflation and 14% yield on 10 years Treasury Bonds in 1981

State Budget

+

Tax Optimizers

take the Profit of

Manipulation

.. .

Savers pay the bill

And the same uggly game on the stock market !!!

see Pic. 3

I say

UN

-

CONSTITUTIONAL

INFLATION TAX

+

EXPR

PRIATION

of Retirement Savings

Reserve

Banks

are to

be

a

Moneytative

State

Authority with

Mutual

Control of the

State Authoritys

exclusively engaged for

STABILITY

... and

not

under control of private Bank Owners

In Germany

we had always the

2nd

Constitutional Hearing

in September

2012 and the

German

Constitutional Court

refer

ed

to the

EU Court of Justice

2014 with

remark

"Competence Occupation

of the European Central Bank",

but

fake

persists

...

constitutionally

un-legitimated

...and

forbidden

by

EU

State Contract

What about

Lehman Brothers Bankrupt and

Go

ldman

&

Sa

chs helps to

manipulate

the Greece

State Budget

...and

Mario Draghi

, President of European

Central Bank,

was a former Vice President of Goldman

&Sachs

in

the

early

years

of the

London short therm interest rate

Manipulation

,

LIBOR

, total volume

unbelievable

800,000 Bil. €uro

Is that

STABILITY

or

"

Q uantitativ E ...

Money

FAKE

"

? ?

If so,

change

Money Based Savings

to

Real

Values

See also the former

US FEDERAL RESERVE President Greenspan

, on footnote

*1)

"Gold stands as a Protector of Property Rights"

Silver

is the

Gold

of the Man in the Street.

But Credits only writen on Paper Notes

The

Bond-

and the

Stock-Market

too are 3-fold

blown up

by the

Money Press,

b

ut

Consumers

+

Savers

WILL

be

the

Victims

of a secret

Deflation TAX

taken by

CRASH

Next to

corruption in money politics

...coin collecting is a nice hobby

(That Property

Consulting

didn´t

cost

you

only

one

Cent

...

please

buy

on

my

offers

)

Buyers from EU countrys:

This offer in EBAY.COM does not include 19% German /European

V

alue

A

dded

T

ax.

So, you have to add this 19% tax to the buy price

, also additional to a best offer price !

Buyers from non EU countrys:

When reaching delivery you will probably have to pay Tax

/

D

utys

depending from law in your country

Remark to Return Policy:

In case of a lower silver price til shipping back I will also

subtract the price difference

from refund

--------------------------------------------------------------------------------------

Payment:

I prefere Paypal as a fast way of overseas payment.

Fast Payment = Fast Shipment :

Your exclusive

silver coin

will come by

Deutsche Post, registered letter, airmail

. I live nearby Frankfurt.

On request I can ship over post centre with transport

DIRECTLY

to

FANKFURT Rhein/Main AIRPORT

(dispatch time depending from target destination 7-10 days, US east coast may be faster, no guaranty)

Packed with commercial invoice in

original

Perth Mint Presentation Box.

Packing, handling + transport to USA/Canada is 19

US$. Inshurance on special request

Shipping to EU

countrys also 20

$.

Sorry I don´t need you change €uro to

US$ and +again to €, exchange

fee to debit of me

(?) and PAYPAL fee on top. So

before bidding

it could be advantageous to contol

my

other offers, if the same item is also offered in EURO

Have much fun and good luck

in bidding on this EBAY auction

Fine precious Silver Coins from Royal Australian Mint

1*)

Gold and Economic Freedom

by

Alan Greenspan

Published in Ayn Rand's "Objectivist" newsletter in 1966, and reprinted in her book,

Capitalism: The Unknown Ideal

, in 1967.

Remark:

Today sopping up the overboarded money volume is not possible... would damage European Currency Union !

The other way out, to retrench the tax displacement back to more income tax a. low consumption tax, is blocked by bankers and the rich people.

So, that

must

cause INFLATION and EXPROPRIATION of money based Retirement Savings

…When business in the United States underwent a mild contraction in 1927, the

Federal Reserve created more paper reserves

in the hope of forestalling any possible bank reserve shortage.

..

…The

excess credit

which the Fed pumped into the economy spilled over into the stock market, triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American

economy collapsed

…

… the welfare state is nothing more than a mechanism by which

governments confiscate

the wealth of the productive members of a society to support a wide variety of welfare schemes...

...A substantial part of the

confiscation is effected by

taxation

.

But the welfare statists were quick to recognize that if they wished to retain political power, the

amount of taxation had to be limited

and they had to resort to programs of

massive deficit spending

, i.e., they had to borrow money, by issuing government bonds, to finance welfare expenditures on a large scale…

... The

law of supply and demand is not to be conned

. As the supply of money (of claims) increases relative to the supply of tangible assets in the economy, prices must eventually rise. Thus the earnings saved by the productive members of the society lose value in terms of goods. When the economy's books are finally balanced, one finds that

this loss in value represents the goods purchased by the government

for welfare or other purposes with the money proceeds of the

government bonds

financed by bank

credit expansio

n

.

..

The financial policy of the welfare state requires that there

be

no way for the owners of wealth to protect themselves

...

...

This is the shabby secret of the welfare statists' tirades against gold.

Deficit spending is simply a scheme for the confiscation

of wealth.

Gold

stands in the way of this insidious process.

Gold stands as a protector of property rights

.

. .

I remember:

The Gold price came up from 450 $/oz in 2005 to 2,060$ (2020) and Silver from 10$ (in 2008) up to 29

$

(2020)

I don´t see the end of

"quantitative money imitating",

Limited PROOF coins on EBAY seems to be

manipulated too.

There´s definetely a difference between (paper compensated short selling) Silver Contracts and

Physical Coins

------------------------------------------

Käufer aus Deutschland sind nur nach vorheriger Anfrage zugelassen.Sie bekommen dann

vor

Vertragschluss die notwendigen rechtlichen Informationen und müssen deren Kenntnisnahme bestätigen sowie

der

zusätzl.

Übernahme von 19% MwSt per eMail zustimmen. Die Zahlungsaufforderung durch EBAY.COM ist ausschließlich außerhalb der EU rechtswirksam, da sie die gesetzl. MwSt gar nicht berücksichtigen kann.

Im Widerrufsfall ist ein Abzug vom Rückerstattungs-Betrag für Wertminderung durch erstmalige Ingebrauchnahme

noch immer höchst umstritten.

Darüber hinaus ist in EBAY.COM eine

PAYPAL Zahlung zwingend vorgeschrieben, ohne daß dem Käufer Möglichkeit zur kostengünstigen Banküberweisung eingeräumt wird ! Hiermit verbundene Preisnachteile, Kosten des 2 maligen Währungstausches sowie Abmahnrisiken und der Vorwurf der Steuer-Vermeidung werden nicht

von mir übernommen !!!